the Creative Commons Attribution 4.0 License.

the Creative Commons Attribution 4.0 License.

Mitigating Drought Financial Risk for Water Supply Sector through Index-Based Insurance Contracts

Gabriela C. Gesualdo

Marcos R. Benso

Fabrício A. R. Navarro

Luis M. Castillo

Eduardo M. Mendiondo

Drought management strategies have primarily focused on structural measures, which are insufficient to prevent water supply disruptions and economic losses. In this concept, adaptation entails anticipating the negative financial consequences of extreme weather events and taking appropriate measures to prevent and mitigate them. As a result, insurance is a valuable adaptation measure for compensating unexpected losses and preventing financial damage from becoming long-term economic damage. We simulated indexed insurance for the Cantareira Water Supply System (CWSS). The system is responsible for providing water to 7.2 million people in the Metropolitan Region of São Paulo (MRSP). Our methodology consists of three steps: (1) describing the indexed variable, (2) computing economic losses depending on event magnitude, and (3) evaluating risk premiums for low, medium, and high coverage levels. According to our findings, an annual fee (premium) of USD 0.43, 0.87, and 1.73 should be charged per person to obtain drought coverage for 3, 6, and 12 months (low, medium, and high levels), respectively. These values account for 1.7 %, 3.4 %, and 6.7 % of the annual costs paid by CWSS-supplied users, accordingly. The premium fee can be incorporated into water bills as a novel technique to pool the risk between supplied users and the utility, thereby protecting them against surcharge fluctuations.

- Article

(869 KB) - Full-text XML

- BibTeX

- EndNote

SDG 13; water management; adaptation measures; hydrological drought

Droughts and floods caused direct losses of roughly USD 1.75 billion per year in Brazil between 1995 and 2014 (Agência Nacional de Águas e Saneamento Básico, 2017). These financial losses can be minimized and compensated through adaptive tools (Navarro et al., 2021), such as insurance against extreme events. In this context, insurance prevents short-term economic damage from becoming long-term economic damage (Seifert-Dähnn, 2018).

The traditional method of developing an insurance scheme entails calculating the insurance premium based on the expected disaster risk (Kunreuther and Michel-Kerjan, 2014). Similarly, the magnitude of the index variable, such as precipitation, streamflow, or reservoir level, triggers the indemnity in index insurance (index-based) (Mohor and Mendiondo, 2017). Despite several successful examples of index insurance application around the world (Le Den et al., 2017; Guillier, 2017; Hanger et al., 2018; Ruiz-Rivera and Lucatello, 2017) development in non-agricultural sectors remain limited.

Therefore, we present the development of index insurance for water utilities. We simulated index insurance for the Cantareira Water Supply System, responsible for providing water to 7.2 million people in the São Paulo Metropolitan Region (SPMR). The region is prone to droughts, the most recent of which occurred in 2014/2015, resulting in water restrictions and rationing in the SPMR. Since then, numerous studies have been conducted to better understand current and future hydrological behavior and to assess water security in the region (Gesualdo et al., 2019; J. S. Sone et al., 2022; Taffarello et al., 2016). Our focus is to identify highly correlated indexes and estimate the size of payouts in case of extreme hydrological conditions in the region. Our findings suggest the creation of a financial tool to reduce losses as an additional water resource management approach.

We simulated index insurance to mitigate drought financial losses for the main contributor to the Cantareira water supply system (CWSS), which supplies the SPMR. The study area of the Jaguari basin is responsible for supplying 46 % of the Cantareira system, which provides water for approximately 7.2 million people in the SPMR (SABESP, 2021). Our methodology comprises (1) characterizing the index variable, (2) calculating economic losses by event magnitude, and (3) estimating risk premiums for low, medium, and high coverage levels.

The first step in creating an indexed insurance contract is determining an appropriate index. To be considered effective, it must be transparent, publicly available, difficult to manipulate, and strongly correlated with the actual financial losses covered by the insurance (Baum et al., 2018; Denaro et al., 2020). The index variable was chosen based on the highest correlation between the candidate's hydrometeorological variables and the reservoir level. The hydrometeorological variables of streamflow and reservoir information were derived from the SABESP, the water and waste management company of CWSS on a daily basis. The daily precipitation was from Brazilian Daily Weather Gridded Data (BR-DWGD) (Xavier et al., 2016), and ERA5 reanalysis replaces the ERA-Interim global climate data (Hersbach et al., 2020). Further information on the utility revenue data, such as Water tariff, Net revenue, Water consumption, and Population served, were obtained from the SABESP in a monthly resolution.

The insurance payment function translates the values of the index (i) into payments (p), which can take different forms. Payments are triggered once the index value is equaled to or exceeded, a strike value (k). This k value is defined as the threshold value of the index, therefore, it may vary according to the level of coverage offered by the insurance contract. For this work, we adopted a strike value of 10 % of the reservoir active volume, i.e., before reaching the so-called dead volume.

The financial risk was measured in terms of per capita per day residential economic losses, based onAubuchon and Morley (2013) equation, and linked to drought-related restrictions on water use. We consider that the contracts are offered by the insurer for a price, or premium (Pr), which can be estimated from the probability of payment distribution. The value of Pr is a function of the expected payouts (E(p)) plus the administrative fees (Af). To reduce the uncertainty of the calculations, we do not consider Af, thereby the values presented here represent the pure risk premium.

In risk contracts, the distribution of the probability of payment has a heavy tail, configuring high payments with a low probability of occurrence at the right end. To adjust this behavior and better indicate the price of risk to extremes, the Wang transformation can be used (Wang, 2002). This transformation adjusts the payout distribution by more heavily weighting low-probability events. Thus, the adjusted risk F*(p) can be determined as in Eq. (1):

where ∅ is the cumulative distribution function of payouts, and λ is the Sharpe ratio, representing market risk. We adopted λ as 0.25 based on weather derivative contracts (Wang, 2002). Thus, the adjusted premium (Pr adjusted) can be determined through the sum of expected payouts (E(p)) times the adjusted risk F*(p), given by Eq. (2):

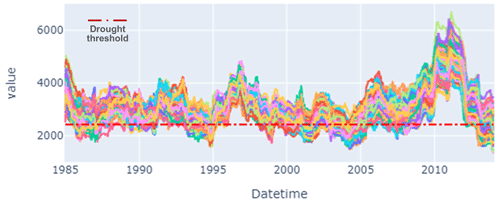

To find the optimal premium value and cope with uncertainty, we need to generate a synthetic series of losses and assess its probability. We used the spatial stochastic model PRSim.wave (Phase Randomization Simulation using wavelets) proposed by Brunner and Gilleland (2020). The model was run 100 times for a 28-year sample of observed data (1985–2013) and obtained 2800 years of simulated data. In addition, we assumed three groups of annual coverage levels – high, medium, and low – representing respectively 12, 6, and 3 months of drought coverage during a 1-year contract. These groups represent the risk aversion of the policyholders, once it related the reservoir level for a given drought period (12, 6, and 3 months) to the economic losses. This exercise considers that the greater the risk aversion, the greater the Willingness to Pay, and consequently the premium value.

In the same year, the association between reservoir level and hydrometeorological factors was minimal. However, because there is typically a large lag between the implementation of conservation measures and revenue losses, correlations between utility revenues and hydrometeorological factors are also assessed, with the index value lagging by 1 to 2 years.

The 2-year lag cumulative precipitation has a strong correlation (Spearman's correlation of 0.84) with the utility reservoir level and therefore the utility revenue, hence is used as the index variable in this study. The strike value (k) is given when the volume is 10 % before the dead volume, less than or equal to 385.7 hm3, and this translates into an index of 2 years lag accumulated precipitation of 2424.3 mm

The observed statistical properties of the precipitation time series were satisfactorily reproduced by the stochastic simulation. We derived the losses distribution and average daily loss of USD 480 000.00 using the stochastic simulation (Data are in constant 2020 USD (United States dollar) – USD 1.00 = BRL 5.15). We computed the loss value for each day the reservoir is below the index (represented as a dashed line in Fig. 1).

Considering the three coverage levels, high, medium, and low, we find out an optimum premium value of USD 0.43, 0.87, and 1.73 for each water user and the respective coverage level. These values correspond to 1.7 %, 3.4 %, and 6.7 % of the annual fee paid in the annual water bills. The hydrologic risk management fee (premium fee) can be included in water bills as a new technique for pooling risk among users and utilities and protecting them from surcharge fluctuations.

The coverage level in this example will be assumed based on the water consumers' willingness to pay (WTP) and risk aversion. Water consumers that have previously encountered water restrictions and rationing are said to be WTP for preventative and adaptation efforts (J. Sone et al., 2022). As a result, we can predict that water consumers in SPMR are more willing to pay for index-based insurance because they have encountered numerous water restrictions over the last 20 years.

We simulate a drought index insurance for the Cantareira Water Supply system. Our results suggest that drought-related financial risks can be the management by water utilities and users to reduce the financial impact of droughts on water users via index-based insurance. As disruptions are difficult to remedy on a short-run basis, index insurance has the potential to significantly reduce the costs of managing financial risk and disruptions. Given the increased frequency and intensity of extreme weather events in the future, we acknowledge the critical necessity of financial mechanisms to minimize losses as an additional solution for water resource management. The findings revealed that utilities and users are exposed to a wide range of hydrologic and climate-related financial risks, particularly in recent years. A variety of factors could contribute to this, including climate change, which alters the frequency and intensity of droughts-related events, and the increasing population and demand in the region.

The code used to process the data and to produce the figures can be requested from the first author.

The daily streamflow time series and reservoir information used in this study are available via SABESP (https://mananciais.sabesp.com.br/Home, last access: 8 March 2023). Furthermore, the daily precipitation DWGD from Xavier et al. (2016, https://doi.org/10.1002/joc.4518) and ERA5 reanalysis from Hersbach et al. (2020, https://doi.org/10.1002/QJ.3803).

GCG: data curation, formal analysis, writing original draft preparation, and review & editing. MRB, FARN, and LMC: writing – review & editing. EMM: conceptualization, supervision, writing – review & editing.

The contact author has declared that none of the authors has any competing interests.

Publisher's note: Copernicus Publications remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

This article is part of the special issue “IAHS2022 – Hydrological sciences in the Anthropocene: Past and future of open, inclusive, innovative, and society-interfacing approaches”. It is a result of the XIth Scientific Assembly of the International Association of Hydrological Sciences (IAHS 2022), Montpellier, France, 29 May–3 June 2022.

The authors would like to acknowledge the graduate program in Hydraulics and Sanitation Engineering of the University of Sao Paulo, São Carlos School of Engineering for the financial and organizational support. We appreciate the invaluable comments and careful reviews provided by the editors and anonymous reviewers.

This research has been supported by the Coordination for the Improvement of Higher Education Personnel (CAPES) (finance Code 001), the National Institute of Science and Technology for Climate Change Phase 2 (INCT-II) under the Brazilian National Council for Scientific and Technological Development (CNPq) (grant no. 465501/2014-1), and the São Paulo Research Support Foundation (FAPESP) (grant no. 2014/50848-9).

This paper was edited by Christophe Cudennec and reviewed by two anonymous referees.

Agência Nacional de Águas e Saneamento Básico (ANA): Conjuntura dos recursos hídricos no Brasil 2017: relatório pleno, ANA, Brasília, http://www.snirh.gov.br/portal/snirh/centrais-de-conteudos/conjuntura-dos-recursos-hidricos/relatorio-conjuntura-2017.pdf/view (last access: 31 May 2022), 2017 (in Portuguese).

Aubuchon, C. P. and Morley, K. M.: The economic value of water: Providing confidence and context to FEMA's methodology, J. Homel. Secur. Emerg., 10, 245–265, https://doi.org/10.1515/JHSEM-2012-0081, 2013.

Baum, R., Characklis, G. W., and Serre, M. L.: Effects of Geographic Diversification on Risk Pooling to Mitigate Drought-Related Financial Losses for Water Utilities, Water Resour. Res., 54, 2561–2579, https://doi.org/10.1002/2017WR021468, 2018.

Brunner, M. I. and Gilleland, E.: Stochastic simulation of streamflow and spatial extremes: a continuous, wavelet-based approach, Hydrol. Earth Syst. Sci., 24, 3967–3982, https://doi.org/10.5194/hess-24-3967-2020, 2020.

Denaro, S., Castelletti, A., Giuliani, M., and Characklis, G.: Insurance Portfolio Diversification Through Bundling for Competing Agents Exposed to Uncorrelated Drought and Flood Risks, Water Resour. Res., 56, e2019WR026443, https://doi.org/10.1029/2019WR026443, 2020.

Gesualdo, G. C., Oliveira, P. T., Rodrigues, D. B. B., and Gupta, H. V.: Assessing water security in the São Paulo metropolitan region under projected climate change, Hydrol. Earth Syst. Sci., 23, 4955–4968, https://doi.org/10.5194/hess-23-4955-2019, 2019.

Guillier, F.: French Insurance and Flood Risk: Assessing the Impact of Prevention Through the Rating of Action Programs for Flood Prevention, Int. J. Disast. Risk Sc., 8, 284–295, https://doi.org/10.1007/s13753-017-0140-y, 2017.

Hanger, S., Linnerooth-Bayer, J., Surminski, S., Nenciu-Posner, C., Lorant, A., Ionescu, R., and Patt, A.: Insurance, Public Assistance, and Household Flood Risk Reduction: A Comparative Study of Austria, England, and Romania, Risk Anal., 38, 680–693, https://doi.org/10.1111/risa.12881, 2018.

Hersbach, H., Bell, B., Berrisford, P., Hirahara, S., Horányi, A., Muñoz-Sabater, J., Nicolas, J., Peubey, C., Radu, R., Schepers, D., Simmons, A., Soci, C., Abdalla, S., Abellan, X., Balsamo, G., Bechtold, P., Biavati, G., Bidlot, J., Bonavita, M., De Chiara, G., Dahlgren, P., Dee, D., Diamantakis, M., Dragani, R., Flemming, J., Forbes, R., Fuentes, M., Geer, A., Haimberger, L., Healy, S., Hogan, R. J., Hólm, E., Janisková, M., Keeley, S., Laloyaux, P., Lopez, P., Lupu, C., Radnoti, G., de Rosnay, P., Rozum, I., Vamborg, F., Villaume, S., and Thépaut, J.-N.: The ERA5 global reanalysis, Q. J. Roy. Meteor. Soc., 146, 1999–2049, https://doi.org/10.1002/QJ.3803, 2020.

Kunreuther, H. and Michel-Kerjan, E.: Economics of Natural Catastrophe Risk Insurance, andbook of the Economics of Risk and Uncertainty, 1, 651–699, https://doi.org/10.1016/B978-0-444-53685-3.00011-8, 2014.

Le Den, X., Persson, M., Benoist, A., Hudson, P., de Ruiter, M., de Ruig, L., and Kuik, O.: Insurance of weather and climate-related disaster risk: inventory and analysis of mechanism to support damage prevention in the EU, https://doi.org/10.2834/40222, 2017.

Mohor, G. S. and Mendiondo, E. M.: Economic indicators of hydrologic drought insurance under water demand and climate change scenarios in a Brazilian context, Ecol. Econ., 140, 66–78, https://doi.org/10.1016/j.ecolecon.2017.04.014, 2017.

Navarro, F. A. R., Gesualdo, G. C., Ferreira, R. G., Rápalo, L. M. C., Benso, M. R., De Macedo, M. B., and Mendiondo, E. M.: A novel multistage risk management applied to water-related disaster using diversity of measures: A theoretical approach. Ecohydrology & Hydrobiology, 21, 443–453, https://doi.org/10.1016/j.ecohyd.2021.07.004, 2021.

Ruiz-Rivera, N. and Lucatello, S.: The interplay between climate change and disaster risk reduction policy: evidence from Mexico, Environ. Hazards-UK, 16, 193–209, https://doi.org/10.1080/17477891.2016.1211506, 2017.

SABESP: Relatório de Sustentabilidade, São Paulo, https://api.mziq.com/mzfilemanager/v2/d/9e47ee51-f833- 4a23-af98-2bac9e54e0b3/f7132489-0141-cf70-79e6-cd9da896bef9?origin=1 (last access: 31 May 2022), 2021. SABESP: Portal dos Mananciais Sabesp – Home, https://mananciais.sabesp.com.br/Home, last access: 8 March 2023 (in Portuguese)

Seifert-Dähnn, I.: Insurance engagement in flood risk reduction – examples from household and business insurance in developed countries, Nat. Hazards Earth Syst. Sci., 18, 2409–2429, https://doi.org/10.5194/nhess-18-2409-2018, 2018.

Sone, J., Gesualdo, G., Schwamback, D., Wendland, E., and Brouwer, R.: Public perception of droughts and water shortages and metropolitan willingness to pay for water saving measures to improve water security, EGU General Assembly 2022, Vienna, Austria, 23–27 May 2022, EGU22-13392, https://doi.org/10.5194/egusphere-egu22-13392, 2022.

Sone, J. S., Araujo, T. F., Gesualdo, G. C., Ballarin, A. S., Carvalho, G. A., Oliveira, P. T. S., and Wendland, E. C.: Water Security in an Uncertain Future: Contrasting Realities from an Availability-Demand Perspective, Water Resour. Manag., 36, 2571–2587, https://doi.org/10.1007/S11269-022-03160-X, 2022.

Taffarello, D., Mohor, G. S., do Carmo Calijuri, M., and Mendiondo, E. M.: Field investigations of the 2013–14 drought through quali-quantitative freshwater monitoring at the headwaters of the Cantareira System, Brazil, Water Int., 41, 776–800, https://doi.org/10.1080/02508060.2016.1188352, 2016.

Wang, S. S.: A Universal Framework for Pricing Financial and Insurance Risks, ASTIN Bull., 32, 213–234, https://doi.org/10.2143/ast.32.2.1027, 2002.

Xavier, A. C., King, C. W., and Scanlon, B. R.: Daily gridded meteorological variables in Brazil (1980–2013), Int. J. Climatol., 36, 2644–2659, https://doi.org/10.1002/joc.4518, 2016.